Wondering why Adjustable Rate Mortgages (ARMs) are popular? While ARMs come with some risks, they can be a smart move when interest rates are on the rise. Let’s explore how an ARM works and why it might be the right choice in the current housing market.

What is an adjustable-rate mortgage?

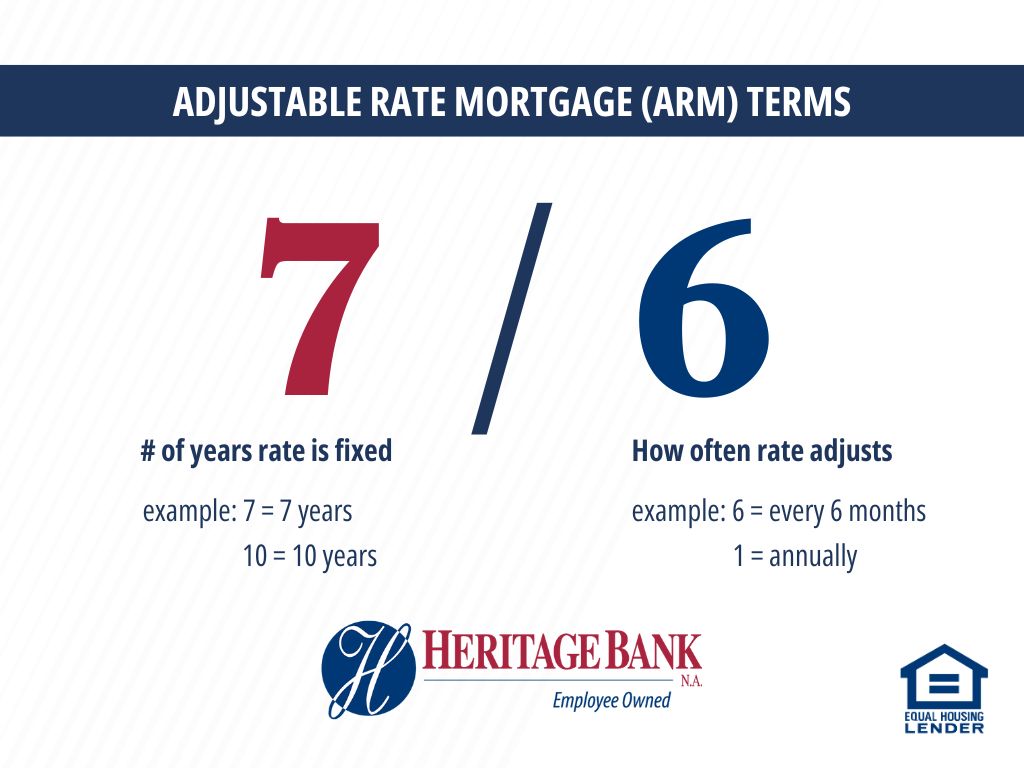

An ARM is a type of home loan with adjustable or variable rates. This means the interest rate you start with will change as market rates increase or decrease. Common types of ARMs are:

- 5-year ARM: A fixed initial rate for the first five years, then an adjustable rate for the rest of the loan term.

- 7-year ARM: A fixed rate for the first seven years, then an adjustable rate.

- 10-year ARM: A fixed rate for the first ten years, then an adjustable rate.

What are the advantages of an adjustable-rate mortgage?

Lower Initial Interest Rates

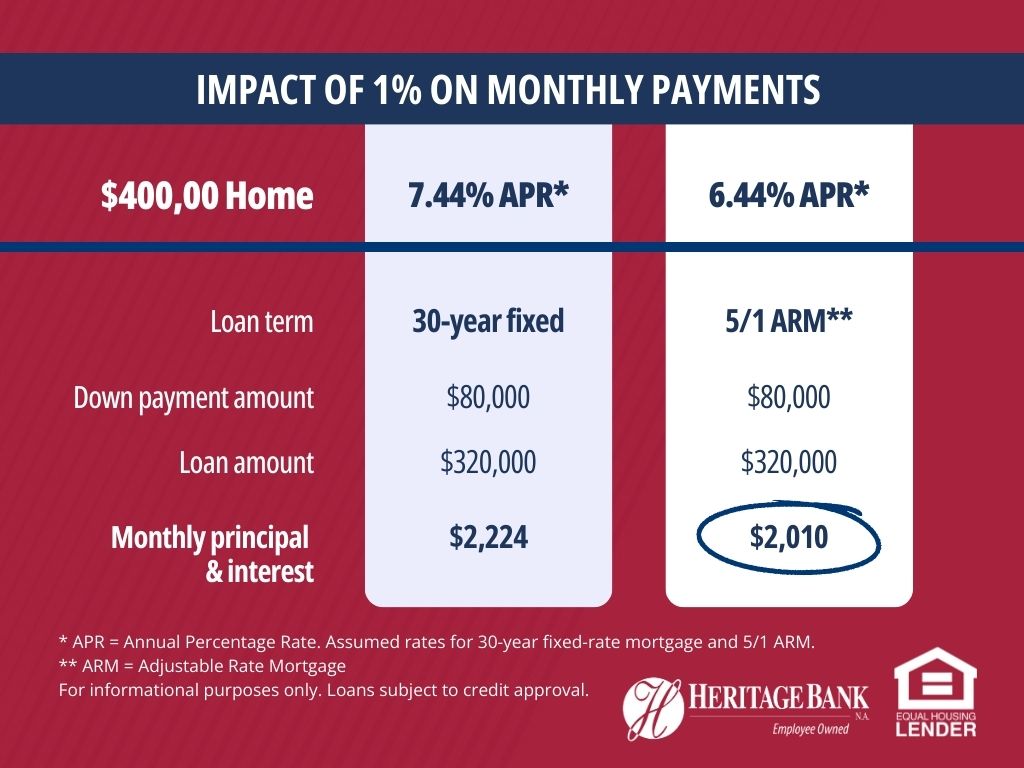

Interest rates for ARMs can be 0.5% or 1% less than rates for a 30-year or 15-year fixed-rate loan. That lower rate could help someone to qualify for a larger loan. In a market where house prices are high and inventory is low, that can be crucial.

In a rising interest rate environment, many people plan to refinance when rates are lower. If you don’t plan to stay on a fixed-rate mortgage for the full term, taking advantage of a lower rate with an ARM makes sense.

Even when interest rates are lower, an ARM can still be a good choice for some. Consider contract workers or medical residents. They may not stay in one location very long and could be selling their homes before the adjustable rate kicks in. They can take advantage of a lower initial rate with a reduced risk of paying an adjustable rate.

Lower Monthly Payments

With a lower initial interest rate, your monthly payments are also lower. For a $400,000 home with a 20% down payment of $80,000 and a 7.44% interest rate, a typical monthly principal and interest payment would be $2,224. That same home with a 6.44% interest rate would have a typical monthly principal and interest payment of $2,010. That’s a savings of more than $200 per month.

Potential to Earn Equity Faster

Don’t need a lower monthly payment? You can take advantage of a lower interest rate by paying more toward the principal each month. This will help you build equity more quickly than you might be able to with a higher-rate fixed-rate mortgage.

This also puts you in a good position if you’re considering refinancing. The more equity you have in your home, the more refinancing options you have available to you.

What are the risks of an adjustable-rate mortgage?

There is a level of uncertainty with an ARM. No one knows whether rates will increase or decrease after the fixed rate period ends. Create a plan with your mortgage loan originator for the future of your loan and revisit your options before the adjustable period begins. Having a plan to refinance to get into a fixed-rate mortgage could help ease concerns over the uncertainty of an adjustable rate.

Carefully weigh the potential advantages of an ARM against the possible risks before making a decision. There is no one-size-fits-all solution when it comes to mortgages. Discuss your individual needs and goals with a knowledgeable mortgage loan originator so you can make the best decision for your situation.

For informational purposes only. Heritage Bank NA is an Equal Housing Lender. All loans are subject to credit approval.