Is credit card debt on your mind?

You’re not alone. Credit card balances increased by $45 billion in the second quarter of 2023, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data.

Looming credit card debt can put a damper on your financial goals. Paying down that debt is a crucial but challenging step toward becoming financially secure. If you’re ready to tackle it, read on for tips and advice.

How can I create a budget that works for me?

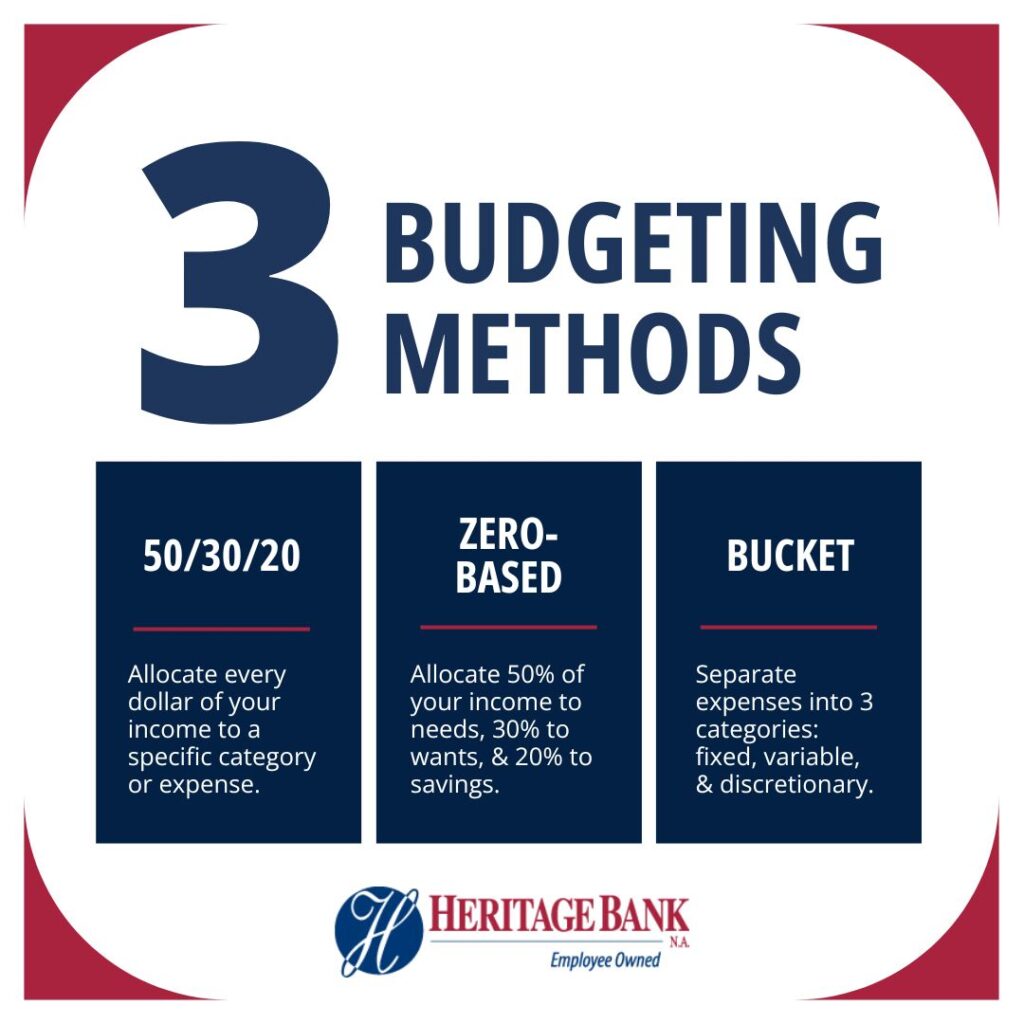

There are more budgeting methods than there are dishes on a Cheesecake Factory menu. How do you go about choosing one? The right method is the one that you understand and can stick to. Here are some common methods.

50/30/20 Budget

With the 50/30/20 budgeting method, you allocate your income to:

- 50% of your income to your Needs (such as mortgage or rent, bills, etc.)

- 30% to your Wants (such as entertainment, eating out, travel, shopping, etc.)

- 20% to Savings (including for debt repayment, an emergency fund, etc.)

Zero-based budgeting

The zero-based budgeting method helps you be more intentional with your spending. With this method, you allocate every dollar of your income to a specific category or expense. In the end, your income minus expenses will equal zero. Start with your bills and recurring expenses and work your way down to spending categories like shopping and entertainment.

Bucket method

If you’re not sure where your money goes, the bucket method of budgeting might be right for you. This method separates expenses into three categories:

- Fixed (such as rent)

- Variable (such as utilities)

- Discretionary (such as entertainment)

Your credit card payment is a variable expense if you continue to use it while paying it down. The amount due will change each month. It’s a fixed expense if you plan to stop using your card while paying it down. You could then pay a set amount each month.

No matter which method you use, you can track your budget in digital banking [link to credit card goal tracking post], a budgeting app, or a spreadsheet.

How do I go about paying down debt?

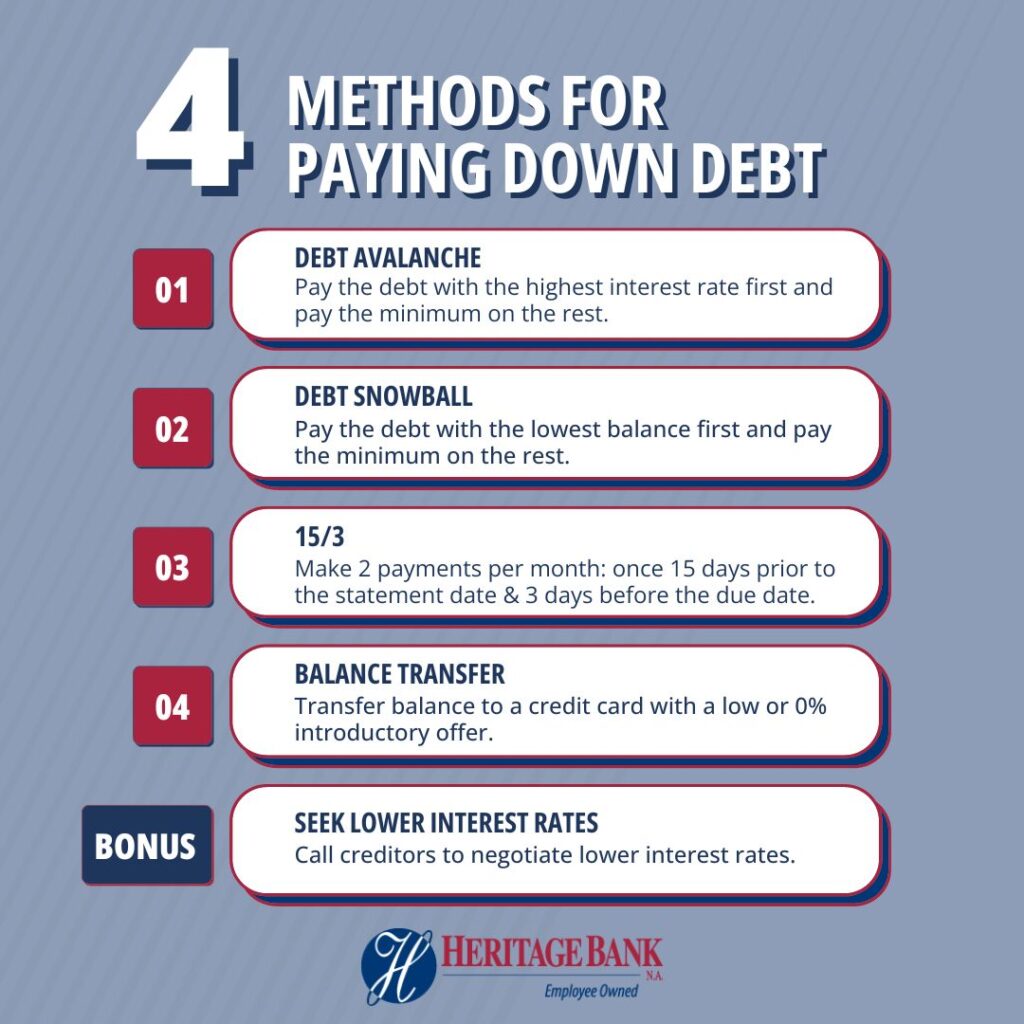

Once you’ve determined how much you can afford to pay, you can choose a method of payment that works best for you. Here are some approaches to consider:

Debt avalanche

Do you have more than one source of debt that you want to pay down? You could consider the debt avalanche method. This focuses on paying off debt with the highest interest rate first and making minimum payments on everything else.

Credit cards often have a higher interest rate than loans, so they will likely be the first target in this approach.

Debt snowball

Similar to the debt avalanche method, the debt snowball method is good for tackling multiple sources of debt. With this method, however, you focus on the debt with the smallest balance first and work up to the largest balance.

This is a good way to get a quick win and feel like you’re making progress toward your goal.

15/3 payment method

Want to be more aggressive with your payments? The 15/3 payment method might be the right approach. With this method you make a payment 15 days before the statement date. Then make a second payment three days before your payment is due.

In addition to paying down your debt faster, this method has a positive impact on your credit score. It helps reduce the percentage of credit you are using. Read on to learn more about credit cards and your credit score.

Balance transfer

If a high interest rate is keeping you from making progress toward your goal, you could consider a balance transfer to a card with a low or 0% introductory rate.

Some things to look out for with this method are:

- If you don’t pay off the balance before the introductory offer ends, you could put yourself in an even worse position. Make sure to have a payment plan in place before you choose this method.

- Opening a new credit card could have a negative impact on your credit score.

Seek lower interest rates

High interest rates don’t need to be a given with credit cards. You can call creditors to try to negotiate lower interest rates on your accounts.

Is it a worthy goal to be debt-free?

Paying off debt can be a much-needed boost of serotonin. But is paying off all your debt the best move?

Not necessarily. When it comes time to take out a loan, having some debt can be key.

Anatomy of a Credit Score

A lender uses your credit score to determine the loan product, loan amount, interest rate, and even whether you qualify for a loan. Your credit score consists of:

- The amounts you owe

- How much new credit you have

- The length of your credit history

- Your payment history

- Your credit mix

Since your score is tied to the age of your open accounts, you could end up lowering your credit score by paying off all your debts and closing lines of credit.

How do I reduce credit card debt without hurting my credit score?

This doesn’t mean you shouldn’t pay down your credit card balances, though. If you’ve had your credit card for a while, it might be the debt with the longest history on your credit report.

So don’t cancel this credit card and don’t bring the balance down to $0. You should maintain a low balance compared to the limit on the card.

For informational purposes only.