FOR IMMEDIATE RELEASE – The Iowa Bankers Association has released the second edition of its Economic Forecast Survey, measuring changes in the economic outlook in Iowa since the first survey was released in January 2015.

The survey asks a representative sample of bankers from across the state to provide their predictions for the next six months on key economic indicators.

“Iowa banks are often the lead economic drivers in their communities, and a principal source of credit to home buyers, small business owners and farmers. As such, Iowa bankers offer valuable insights into state economic trends,” said John Sorensen, president and CEO of the Iowa Bankers Association (IBA).

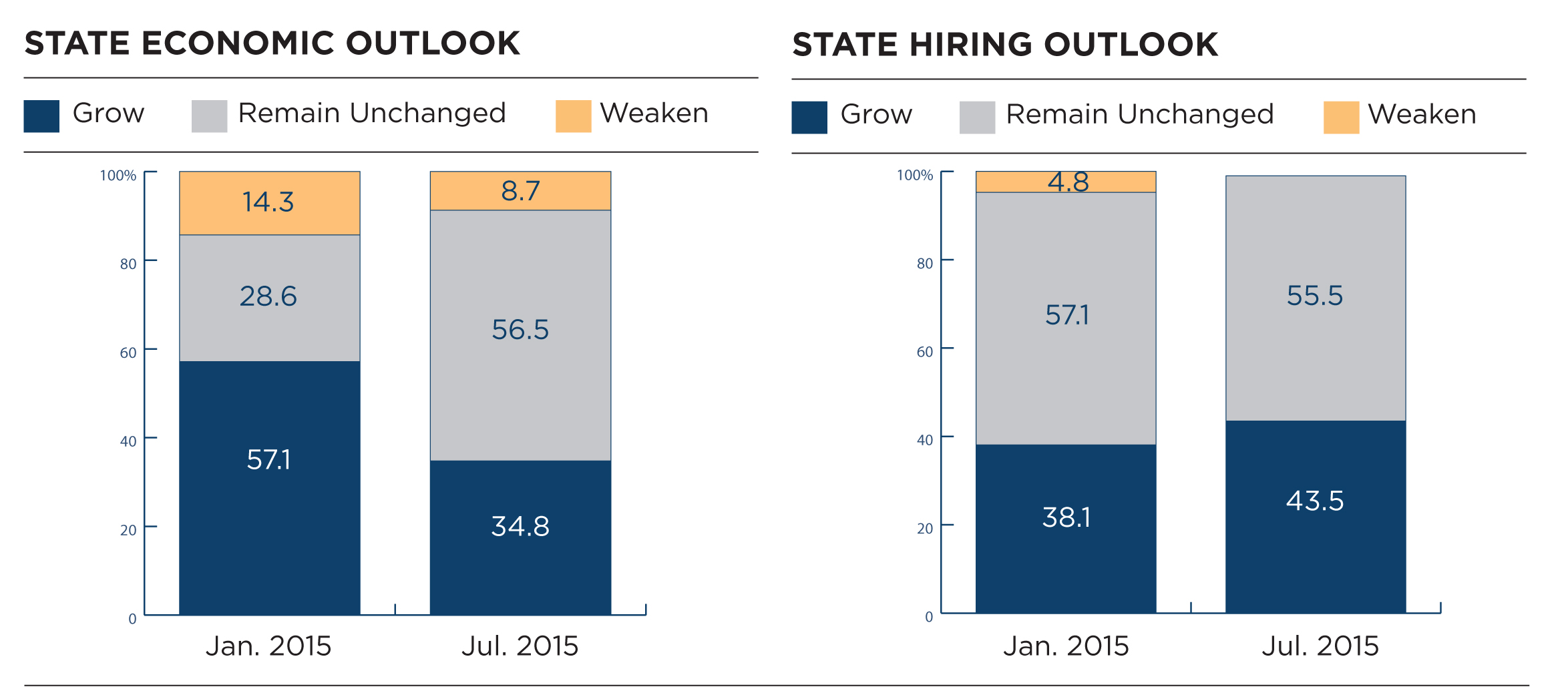

STATE ECONOMIC AND HIRING OUTLOOK

In this recent survey, responses from bankers generally suggest the overall economy will continue its moderate growth and the jobs outlook will remain positive. “These improvements, combined with continued low interest rates, should have a positive impact in the areas of housing and consumer spending,” said Sorensen.

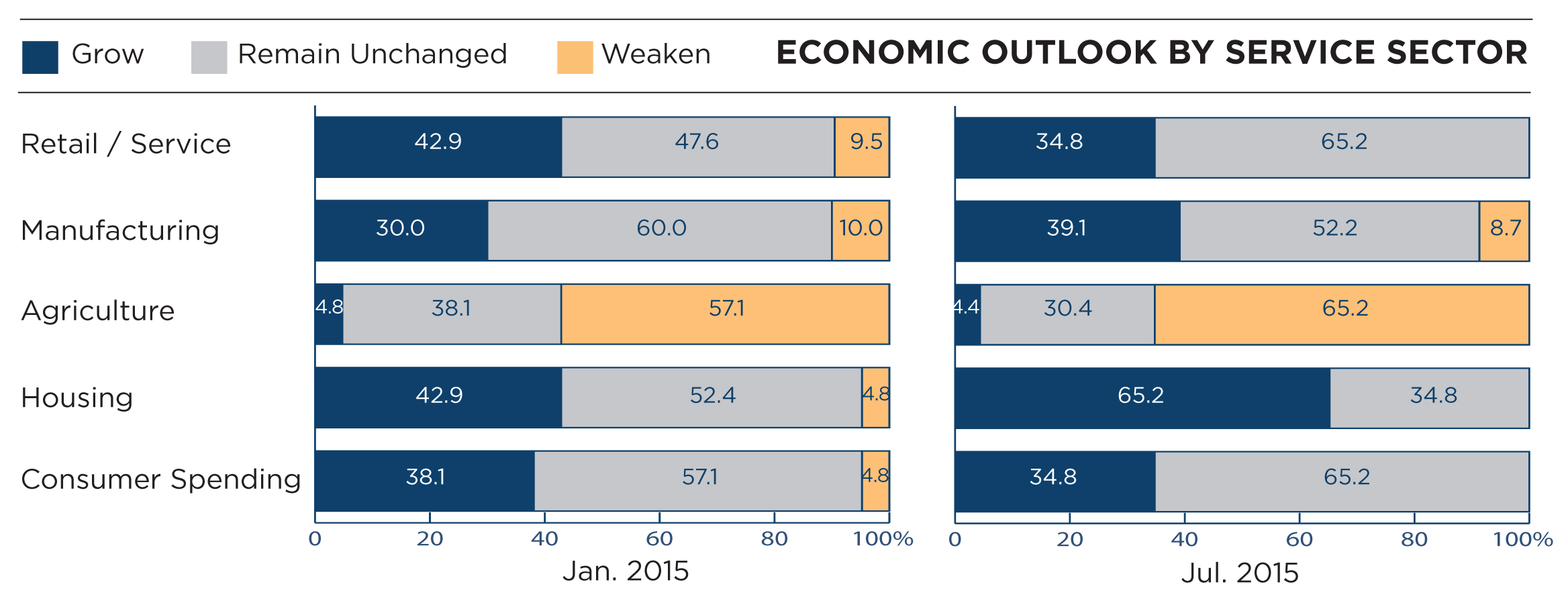

ECONOMIC OUTLOOK BY SERVICE SECTOR

Both the retail/service and consumer spending sectors look to remain steady over the next six months, according to the survey results, while the agriculture sector is predicted to continue softening as a result of lower commodity prices. The bankers surveyed view housing to be an area of economic growth — largely a result of pent-up demand and continued low interest rates.

Manufacturing is also showing strength despite a slow-down in demand for agriculture equipment, providing evidence that Iowa has diversified its manufacturing base.

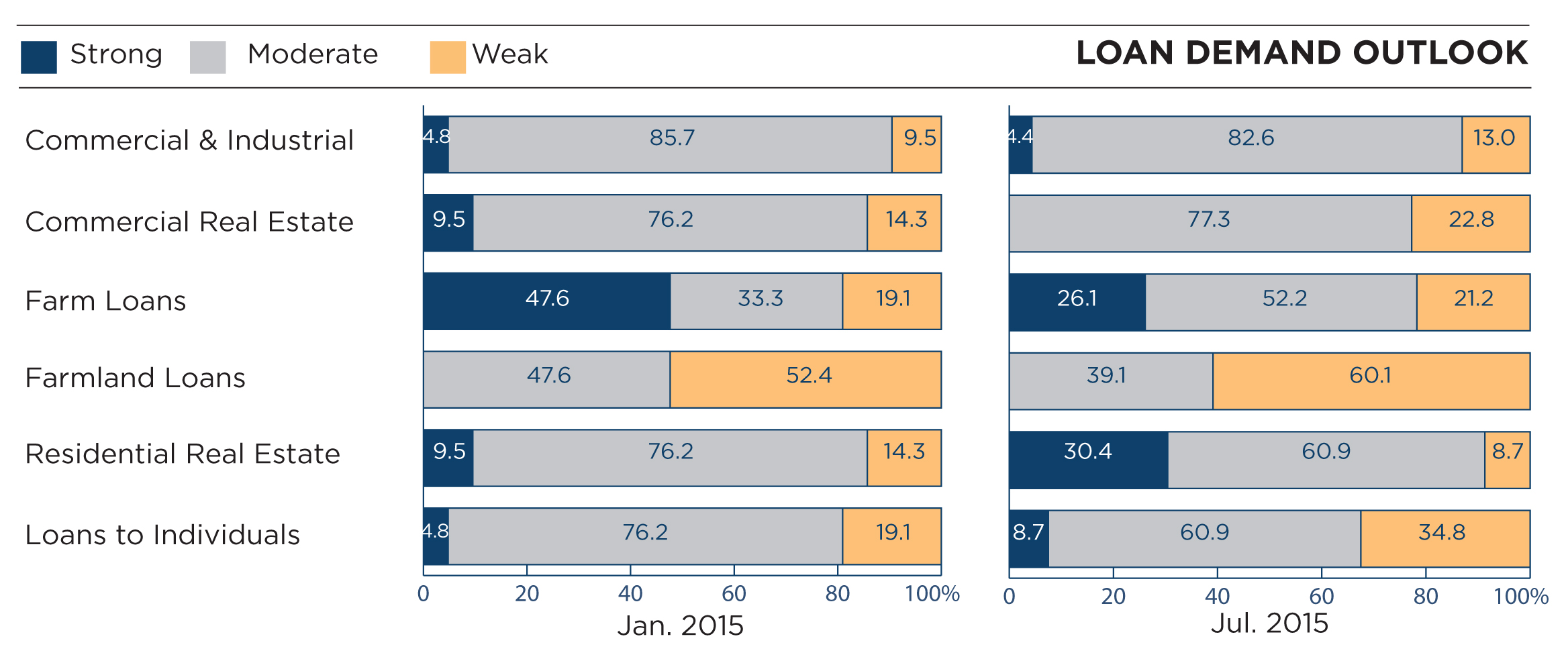

LOAN DEMAND OUTLOOK

“Loan demand is reflective of economic conditions,” said Sorensen. Persistently low crop prices and elevated input costs has increased short-term financing needs for farmers, as reflected in the survey. Conversely, lower farm income has translated to reduced demand for agriculture real estate loans. Residential loan demand continues to grow, putting upward pressure on housing prices.

“Federal Reserve Chair Janet Yellen’s recent comments that the Fed remains on track to raise rates this year — as long as the economy evolves as expected — could slow the trend,” said Sorensen.

Demand in the other sectors is predicted to remain steady.

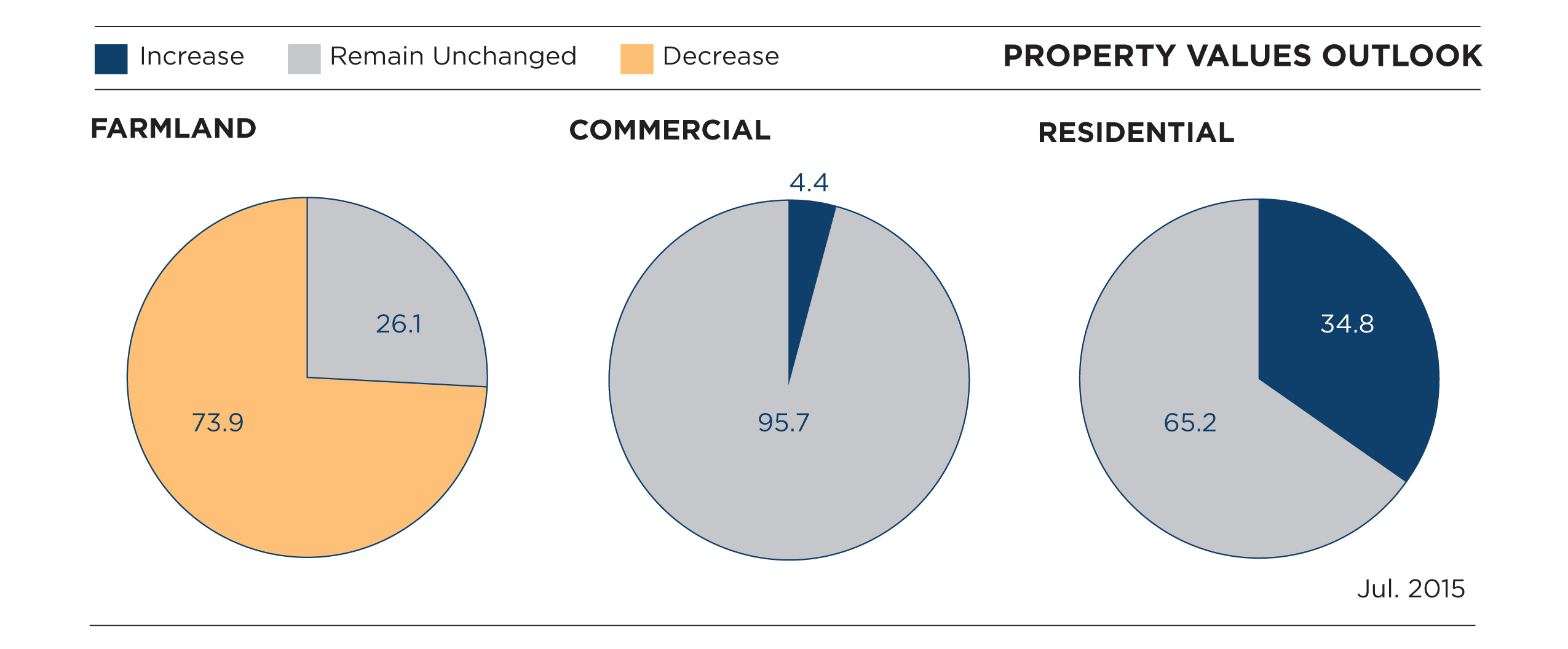

PROPERTY VALUES OUTLOOK

The survey indicates variability in property values during the next six months, with agricultural property values clearly experiencing the greatest downward pressure. “Farmers generally have strong equity in their operations and manageable levels of debt,” Sorensen added. “Iowa bankers are dedicated to providing meaningful and experienced assistance to farmers as they manage through the current environment.”

ABOUT THE IOWA BANKERS ASSOCIATION

The Iowa Bankers Association represents 334 Iowa banks and savings institutions. Iowa bankers are committed to the values of honesty, hard work and community service, and have been a trusted resource for Iowans for more than 100 years. Iowa banks offer FDIC insurance and lend more than $49.6 billion to help individuals, business owners and agriculture. More than 18,000 Iowans work at an Iowa bank, and Iowa banks donate more than $30.5 million and 600,000 volunteer hours to support local communities each year. To learn more, visit iowabankers.com.